An Unbiased View of Estate Planning Attorney

Table of ContentsGetting My Estate Planning Attorney To WorkThe Main Principles Of Estate Planning Attorney The Facts About Estate Planning Attorney UncoveredUnknown Facts About Estate Planning Attorney

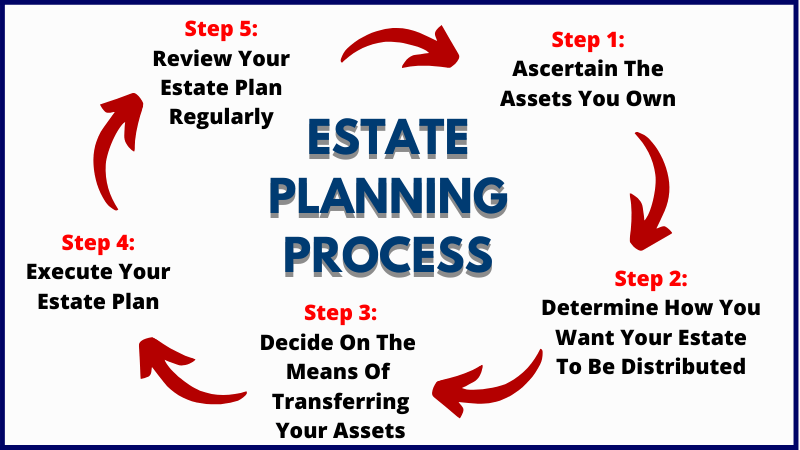

Estate planning is an action strategy you can make use of to determine what happens to your possessions and responsibilities while you live and after you die. A will, on the other hand, is a lawful paper that describes how properties are distributed, that cares for children and pet dogs, and any type of other dreams after you die.

The executor additionally has to repay any tax obligations and financial obligation owed by the deceased from the estate. Lenders usually have a limited amount of time from the day they were notified of the testator's death to make insurance claims versus the estate for cash owed to them. Claims that are rejected by the executor can be brought to justice where a probate judge will certainly have the last say regarding whether or not the claim stands.

Estate Planning Attorney Things To Know Before You Buy

After the supply of the estate has been taken, the worth of assets determined, and taxes and financial obligation repaid, the executor will certainly after that seek authorization from the court to distribute whatever is left of the estate to the beneficiaries. Any kind of estate tax obligations that are pending will come due within nine months of the day of death.

Each individual places their assets in the count on and names somebody besides their spouse as the beneficiary. A-B trust funds have actually ended up being less popular as the inheritance tax exception functions well for a lot of estates. Grandparents might transfer assets to an entity, such as a 529 strategy, to sustain grandchildrens' education.

Estate Planning Attorney Can Be Fun For Everyone

Estate coordinators can collaborate with the contributor in order to reduce taxed revenue as a result of those payments or formulate approaches that make best use of the impact of those contributions. This is another approach that can be utilized to restrict death tax obligations. It entails a private securing in the current value, and hence tax responsibility, of their residential property, while attributing the value of future development of that resources to one more person. This approach involves freezing the worth of a property at its value on the date of transfer. Accordingly, the quantity of possible capital gain at death is additionally frozen, allowing the estate organizer to approximate their prospective tax obligation liability upon death and much better strategy for the repayment of revenue taxes.

If adequate insurance coverage proceeds are available and the plans are appropriately structured, any type of earnings tax obligation on the regarded personalities of possessions adhering to the fatality of an individual can be paid without resorting to the sale of properties. Profits from life insurance policy that are received by the recipients upon the death of the insured are generally revenue tax-free.

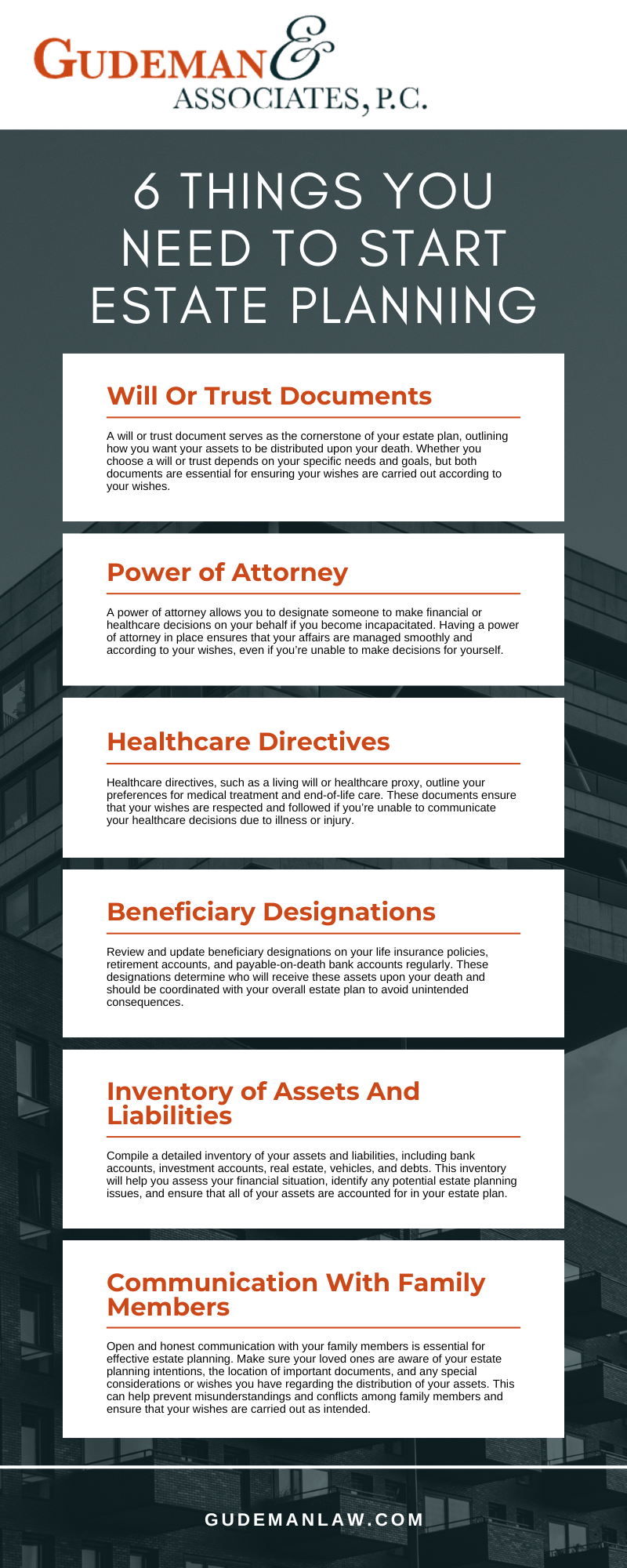

Other fees related to estate planning consist of the preparation of a will, which can be as reduced as a few hundred dollars if you make use of one of the finest online will certainly makers. There are certain files you'll need as part of the estate preparation process - Estate Planning Attorney. Some useful site of the most typical ones include wills, powers of attorney (POAs), guardianship classifications, and living wills.

There is a misconception that estate planning is just for high-net-worth individuals. Estate preparing makes it much easier for individuals to identify their desires prior to and after they pass away.

7 Easy Facts About Estate Planning Attorney Explained

You must begin preparing for your estate as soon as you have any kind of measurable possession base. It's an ongoing process: as life proceeds, your estate strategy should move to match your scenarios, according browse this site to your brand-new objectives. And maintain it. Refraining from doing your estate planning can create excessive financial concerns to loved ones.

Estate planning is frequently believed of as a tool for the wealthy. Estate planning is likewise a terrific method for you to lay out strategies for the treatment of your minor kids and animals and to describe your wishes for your funeral service and preferred charities.

Applications should be. Qualified applicants that pass the examination will right here be formally accredited in August. If you're eligible to rest for the examination from a previous application, you may submit the short application. According to the policies, no accreditation shall last for a duration longer than 5 years. Discover when your recertification application schedules.